Top 5 Accounting Software Applications For Mac

Best Accounting Software 2017 (Picture: GotCredit, Flickr). The days of dowdy accounting software – that which was made to keep accountants in business and infuriate business users – are behind us. Lead by several ‘Software as a Service’ providers, old players in the market have been forced to raise their usability game and streamline the weekly, monthly and annual administrative tasks you need to complete to keep things rolling along smoothly. Today, instead of paying hundreds of dollars each year for the latest version of your software, you can pay a monthly fee that not only gives you anywhere/anytime access to your data, but also is updated whenever a new accounting rule is made law or an old regulation is updated. The new subscription-based software licensing models means that the old “one license = one computer” system has been smashed. As long as you can get to a web browser and remember your login details, you can raise an invoice, process a payment, reconcile your bank statement and even complete your BAS. Today, you don’t need to install accounting software.

Relatively new players in the accounting software business, who brought cloud services to business and accounting software, compete with established marques like QuickBooks, Reckon, and MYOB. The new players have upped the ante, forcing the old-timers to lift their game and make their applications easier to use, more reliable and up to date. Six things to consider Before jumping in and subscribing to a cloud-based accounting solution, there are a few things you need to consider. Annual fees: With a cloud-based service, you’re moving to a rental or access fee – you’re not actually buying the software. Instead of making a capital software purchase you’ll need to budget for monthly or annual payments. Depending on your needs that could be as little as a few dollars a month up to hundreds.

Many Software as a Service (SaaS) providers tell you they’re a cheaper option. But it’s more likely they’re just smearing similar costs over a longer period, much like taking on low or interest-free financing from a furniture store – except that you never actually own the software. Your data: SaaS providers don’t just provide the software – they also hold your data. In some cases, getting hold of your data so you can switch provider or make your own backups can be tricky.

And while SaaS providers do their best to protect your data, it’s still up to you to keep reliable backups. Integration: As your business grows and you invest in more SaaS you will probably want different services to work together. For example, you might want the invoicing module in your accounting software to work with your customer relationship system.

Do your research to ensure the accounting system you choose can integrate with other applications you might need in future. And don’t forget your address book – having a single address record for all your customers, suppliers and other partners will ensure you don’t have to maintain the same data in multiple systems. Workflow: When you commit to a new software package there will be some necessary adjustment on your part. You’ll need to learn how to use the software to carry out everyday tasks such as entering invoices and receipts as well as produce your monthly or quarterly BAS and reports your accountant will need for preparing your tax return.

Bank feeds: Cloud-based accounting systems can directly connect to most banks and collect transaction data, saving you the effort of manually typing every transaction. Make sure your bank or financial institution is properly supported. For example, I’ve seen some credit card feeds that are only partially supported resulting in slow feeds or connection errors. Multi-platform and mobile: Although you might do most of your accounting work on a desktop or notebook computer, being able to raise an invoice from a smartphone, or check outstanding accounts from your phone can be handy when visiting a customer. The top 5 best accounting software packages in 2017 in a nutshell There are many different cloud-based accounting packages to choose from.

I’m focusing on the five I think are most likely to make your shortlist of options. Free trial: Yes Price: from $25-60 per month Xero is to online accounting software what Intel is processors. It’s not the only game in town but they have a massive market following and great popularity. The New Zealand-based SaaS was founded over a decade ago and continues to grow.

Xero was created for business users, not accountants. However, they have now created a massive ecosystem of accountants who can work directly with business owners to assist them. So, while you could use Xero to enter invoices and reconcile statements, your accountant can easily and securely access your information to prepare your BAS and do your annual tax return. Like all the other applications, Xero launches with a dashboard that displays the information you need to have front and centre with activity buttons where you’d expect them. For example, there’s a dashboard panel with a list of outstanding invoices. On that panel, there’s a button to create a new invoice. The same goes with the “Bills you need to pay” and “Expense claims” panels.

You move the panels around to suit your preferences. Connectivity to other SaaS providers is available from the Settings and checking out the Add-ins. There are add-ins for many different vertical industries such as education, hospitality, manufacturing, and not for profits. There’s also integration for various point of sale and payment systems. For example, you could purchase the $40 Square contactless payment device and your Square account will integrate directly with Xero. Payroll is also included, although the entry-level subscription, for $35 per month, limits that to a single employee – which is fine for a sole trader.

You’ll need to stump up for a higher subscription level if you have more staff. Automatic superannuation payment management kicks in at $60 per month and you won’t get multi-currency support without paying at least $60 per month. That pricing structure has changed over the years. Feature-wise, the $25 and $50 options are the same.

However, the cheaper plan limits the number of transactions you can enter quite significantly – you only get five invoices, five bills, payroll for one employee and just 20 bank transactions. If you're running a full-time business, those limits are likely to push you straight to $50 per month.

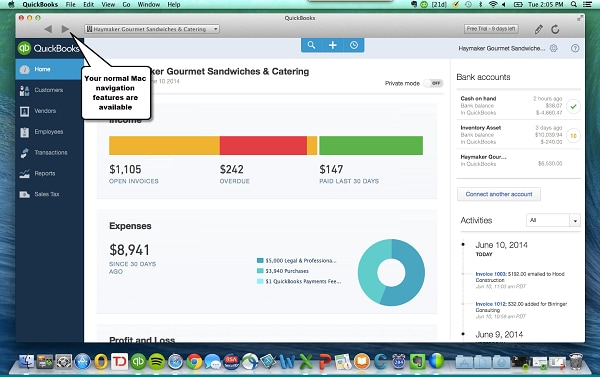

Xero’s mobile app for iOS is easy to use and doesn’t try to shoehorn the entire online experience onto the smaller screen. Adding invoices and expenses is easy with the app limiting data entry to those two activities and the management of contacts – the key activities you’re most likely to need when on the road. The app uses Touch ID so it requires your finger or a PIN for access. Free trial: Yes, Monthly Price: from $15 per month QuickBooks is another veteran of the accounting software business. Like the other apps I looked at, there’s an attractive dashboard that puts key data such as income (split into open, overdue and paid in the last 30 days), expenses and profit and loss in front of you as soon as you log in. The account creation process sent a verification code to my phone rather than just relying on email.

And there’s an option to help with bringing data across from Excel, Reckon, MYOB or Reckon as well. A guided process helps you add your company logo to QuickBooks as well as customise invoices, connect with an accountant and carry out a few other start-up activities. Once you create a free account – you don’t need to use a credit card – you can access a sample account so you play around with QuickBooks before entering all your own data. However, finding this data requires either searching for “sample file” in the help after you’ve logged in. The plus sign on the menu bar gives two-click access so you can enter the most common business documents such as invoices, expenses and timesheets.

Payroll and inventory management are available but cost extra. One thing I liked was the instant view of my GST status.

With a single click of the GST menu on the left side of the dashboard, I received an instant snapshot of what I’ll owe the government on my next BAS. Similarly, there’s an instant snapshot of your bank account balances and how many unreconciled transactions there are in QuickBooks. Creating invoices, receiving payments and other common actions were easy. There’s also an option for integrating PayPal into your invoices so you can receive credit card payments.

Although PayPal’s fees can be on the high side, this can be useful for a business that’s starting up and not quite ready to set up a payment gateway with their bank. The mobile app for iOS relies on two-factor authentication when it’s first used. Creating invoices, entering expenses and managing contacts were easy. The app supports downloading bank transactions making it one of the more fully-featured mobile apps in this category. Free trial: Yes – 30 days Price: $25 to $50 per month MYOB was the default option for businesses who needed accounting software. It has been around for decades and enjoys a great global reputation. But, it took the company a while to get on-board with cloud software.

After a few attempts, they have got it right with Essentials. It no longer has MYOB's old “accountants first” mode. It is now an attractive and user-friendly application. The dashboard provides all the data in plain English terms like “Money in” and “Money out. I'm not an accountant so those sorts of descriptions are very helpful. Creating invoices, paying bills and other common actions are rarely more than a click or two away on the top menu.

But, like Saasu, it would benefit from having some shortcut buttons on the Dashboard rather than two clicks away in a menu. That would also make the application more touchscreen friendly. Essentials can store scanned documents. For example, when entering a bill, there is a 'Link Document' button which lets me upload a scanned document.

If I receive a paper bill from a supplier, I can scan and store the paper inside Essentials and link it to a payment so the entire transaction trail is in one place. You can also email documents to your Essentials account. Unfortunately, it doesn’t link to cloud storage services so you can end up with two copies of documents if you don’t keep tight document management processes. There are plenty of reports in the application, ready to go including the essential GST report for completing your BAS as well as Profit and Loss (with a graphical version in beta testing), Balance Sheet and Trial Balance so you can keep your accountant happy. Many accountants still preferring their clients to use MYOB so there’s an easy export function so you can grab all the data your accountant wants and send it off in a single file. And there are options to import data from other systems if you're making the move from another accounting package. Unfortunately, Essentials doesn’t provide you with sample company data to play with.

The only way to use the free trial is to enter your own data into the application – a time consuming task if you’re in the process of simply shortlisting your options. The MYOB on the Go app lets you send invoices and receive payments while you’re out and about. It works with the MYOB PayDirect Reader so you can receive credit card payments. And through MYOB’s investment in point of sale system Kounta, you can also integrate a cash register solution. Free trial: Yes – 30 days Price: Between $5 and $37 per month depending on features Reckon One is the cloud accounting software service delivered by established industry veteran Reckon.

The software looks good, is easy to use and the dashboard you see when you first connect to your company file puts important information front and centre. For example, you won’t have to scramble around to see how many bills you need to pay or how many invoices are overdue. You can, if you have linked your accounts, see bank balances and track them over past months. Pricing is competitive.

The core module, is just $5 per month but you’ll want to add invoicing for $3 and BankData for another $3. There is a free trial. Those are minimum fees with higher monthly costs depending on your transaction volumes. But the most you’ll pay, if you opt for the maximum transaction volumes and take up the payroll, project management and time and materials tracking is $37 per month. Using a trial account with dummy data I was able to easily create invoices, pretend to receive payments, track account balances and manage outstanding payments.

Even if you’ve never used accounting software, you’ll find Reckon One easy to use. The GST summary report, used for completing your monthly or quarterly BAS loaded quickly. Profit and Loss, Trial Balance and a Balance Sheet were also snappy. Reports are categorised although you can easily create shortcuts to your favourites so you need not go digging through the categories each time you need to load a report. The mobile app – I tested the iOS version on an iPhone 7 Plus, worked well but is in dire need of an update.

For example, I used a Google account to log into Reckon One but that I couldn’t use that account on the mobile app. The user interface on the iOS app looks like it comes from the days of the iPhone 4 and needs some developer love. Free trial: Yes Price: $15 to $180 per month. Read more Like all the other online account apps, Saasu launches with a main dashboard which puts a summary of your Profit and Loss report, cash-flow, and Balance Sheet front and centre along with outstanding invoices, with overdue items highlighted in red, and outstanding bills you need to pay.

You can rearrange or remove components depending on your preferences. Both the outstanding invoices and payments can set to display all items or a summarised, per debtor or creditor view. Annoyingly, there's no one-click access to carry out common activities such as adding a new invoice or purchase. I either needed to go to the sales screen or click the add button on the top menu and then choose sale from the list of items.

A simple “Add new invoice” button on the dashboard would easily reduce the amount of clicking around – especially with so many of us now using touchscreens. Saasu supports payroll, bank feeds and inventory management although the number of annual transactions you can perform, employees you can have and bank feeds varies depending on your subscription level. At $15 per month, you get 1000 transactions for the year, three bank feeds, no payroll or inventory management. For $180 per month, you get 100,000 transactions, 20 bank feeds, 100 employees and a slew of other features. If you're looking for a service with an elegant smartphone app – Saasu is probably not the application for you. While it can be used to enter sales and purchases, simple tasks such as choosing whether to create a sale or purchase are a pain. For example I couldn’t edit the GST code for a sale as it would only take the default information for when I set the account up.

Credit: Lightspring/Shutterstock Small business accounting software helps you manage your finances by tracking the money you receive, owe and are owed. We looked for affordable, easy-to-use accounting programs designed for small businesses. We wanted them to be cloud-based and have mobile apps so you can access your data anytime, anyplace. We also looked for accounting systems with features to save you time, such as automated bank feeds, online invoicing and automatic payment reminders. Here are our best picks and details about our selection process. If you want to learn more about what you should look for in accounting software, read our.

Best Accounting Software. Buyerzone widget Best Small Business Accounting Software Overall: QuickBooks Online QuickBooks Online from Intuit is one of the most popular small business accounting solutions on the market – and our pick for the best business accounting software overall.

It's easy to use and loaded with features, including several that can save you time. The company estimates that, on average, it saves its users 40 hours each month on accounting tasks. It can be used by nearly every type of business and has plans for businesses of all sizes, from self-employed individuals to small businesses with basic accounting needs to established businesses that need advanced features such as time, project and inventory tracking. Best Invoicing Software: FreshBooks Although all accounting software products have invoicing tools, FreshBooks' are incredibly easy to use, which is why we picked it as the best invoicing software for small businesses. The WYSIWYG format is intuitive, and with just a few clicks you can add billable time and expenses, customize the look of the invoice, and set up recurring invoices, automatic payment reminders and late fees.

This accounting software connects to your bank, generates several reports, tracks time and helps you manage projects. Best Accounting Software for Mac: Xero Mac users often grapple with the issue of stripped-down business software that isn't as capable or intuitive as its Windows counterpart.

Xero's cloud-based accounting software, which is available for both PC and Mac, is our pick for the best accounting software for Mac because it's a full-featured solution that doesn't compromise on features or ease of use just because you're using a Mac. It can save you time and simplify accounting by automating tasks and integrating with more than 700 apps. Xero also comes with 24/7 email and live chat support and outbound phone assistance at no extra cost. Best Accounting Software for Really Small Businesses: Zoho Books Really small businesses need really simple accounting software. Zoho Books offers all of the basic features that microbusinesses need as well as advanced tools like project billing and time tracking.

It also has integrations, so you can continue using the software as your business grows. We selected it as the best accounting software for really small businesses for its simplicity and value, because compared to other accounting software in its class, Zoho Books has the best price for all of its capabilities. Best Free Small Business Accounting Software: Wave Financial Not all small businesses need the extra features and support that paid accounting services provide. Wave Financial offers free, cloud-based accounting software specifically designed for small businesses. Unlike free accounting software programs that limit their capabilities, Wave Financial offers a comprehensive set of accounting features without the monthly price tag, which is why it's our pick for the best free small business accounting software.

Accounting Software Frequently Asked Questions Q: Which small business accounting system is best? A: In our research, we found QuickBooks Online to be the best small business accounting system overall. But, depending on the specific needs of your business, another system may be a better fit or better value. For example, if your business provides a service and works with clients on a project basis, FreshBooks might be the best choice for you because of its project management features. See our best picks above to see our recommendations for different business sizes and needs. Q: What do you need from your accounting software?

A: You need accounting software that tracks the money moving in and out of your business, with both accounts payable and accounts receivable features. It should connect to your bank and credit card accounts and automatically download your transactions. If your business is service-based, you may need project management tools. If your business sells products, you may need inventory management features.

Ideally, the software will have integrations that connect it to the other business applications you use, such as your point-of-sale system, customer relationship management software or email marketing service. Q: Do you need online bookkeeping software instead of accounting software? A: For small businesses, the term 'online bookkeeping software' is interchangeable with online accounting software (but there is a difference between bookkeepers and accountants – check out to learn more). All the best online accounting programs for small businesses have bookkeeping features that allow you to record debit and credit transactions as well as accounting features that let you run reports and analyze your business's financial performance. Q: What does an online accounting service do?

A: Online accounting services can perform a wide range of tasks for busy business owners. Some focus on bookkeeping duties such as entering and categorizing transactions, reconciling accounts, and generating financial statements and reports that you can take to your CPA at tax time. Others provide payroll and tax preparations services. Some, such as virtual controllers, CFOs and CPAs, provide high-level accounting services like internal audits and financial planning and analysis. Our Accounting Review Methodology To find the best accounting software for small businesses, we began by asking business owners which accounting software they use, what they love about it and what they think makes it the 'perfect' accounting application.

We also researched popular accounting software that frequently appears on reputable review websites, top lists and business websites. We then created an extensive list of accounting software that included software from our research, applications we were already familiar with and vendors that have previously pitched their software to us.

We narrowed down this list based on different use cases and a wide range of criteria, including cost, features and limitations. As part of our research, we studied user reviews, watched tutorial videos, and checked out customer resources offered by each vendor, such as knowledgebases, blogs and guides. Next, we evaluated each program by signing up for a trial or demo account and testing the software ourselves. This firsthand experience helped us understand how the features work and whether the programs are worth their price tags.

It also helped us assess whether the software is as easy to use as each vendor claims. To further inform our decisions, we contacted each vendor to measure the quality of its customer support. Although we started with more than 100 accounting software products on our list, only 11 of those made it to our short list: Billy, FreeAgent, FreshBooks, Intuit QuickBooks Online, Kashoo, OneUp, Sage One, Wave Financial, Xero, ZipBooks and Zoho Books. Our picks for the top accounting software programs are QuickBooks Online, FreshBooks, Xero, Zoho Books and Wave Financial. What to Expect From Accounting Software in 2019 Accounting software companies, recognizing that many of their users are small business owners who don't have an accounting background, continue to make their products easier to use.

Top 5 Accounting Software Applications For Mac Download

They're using technology like AI and machine learning to automate repetitive tasks and reduce the need for manual data entry. When you're categorizing transactions, for example, the software learns to recognize how you categorize things so it can do it for you automatically (and if it gets something wrong, you can easily fix it by categorizing it manually). Also in 2019, more accounting software companies will offer cloud-based solutions for a monthly subscription. Researchers at Gartner Inc. Predict that by 2020, 80 percent of all software vendors – both new and legacy – will offer subscription-based services. The advantages of cloud-based accounting software are better security, regular updates and web-based accounts that you can access anywhere using any device with a browser.

Integration continues to be an important consideration for small business owners, and the best accounting software applications offer add-ons or integrations with multiple third-party business programs and services. Being able to sync sales data from your POS system to your accounting software, or your customer list from your accounting software to your email marketing service, for instance, eliminates time-consuming data entry or the frustration of downloading and uploading files from one application to another. Editor's note: Looking for information on accounting software for your business? Use the questionnaire below, and our vendor partners will contact you to provide you with the information and quotes you need. Buyerzone widget Here's a full list of accounting software vendors and a summary of what each company says it offers. This alphabetical list also includes our best picks. AccountEdge – AccountEdge offers two versions of its accounting software, plus an ERP through its parent company, Priority.

AccountEdge Basic helps sole proprietors automate their bookkeeping, while AccountEdge Pro is full-featured accounting software for small businesses. Both are desktop-based with a one-time fee.

If you want remote access, a cloud collaboration tool is available for the Pro plan as an add-on. And Co – And Co from Fiverr is free business software for freelancers that provides many of the standard services associated with accounting software, including invoicing, subscription billing, expense and time tracking, and reporting. Its app is available for both iPhone and Android phones, and it integrates with other popular applications like Stripe, PayPal, Zapier, Slack and MailChimp.

Bench – Bench is an online platform that provides bookkeeping software and services to small businesses. The company estimates that its AI-enabled platform can automate 75 percent of a bookkeeper's typical tasks. It syncs with your business bank and credit card accounts, provides monthly financial statements with visual reports, and offers support to your CPA at tax season.

When you have questions about your finances, you can contact your dedicated bookkeeper and receive a response within one business day. Billy – Billy is attractive, basic accounting software for small service-oriented businesses. With it, you can record expenses, generate reports, and create quotes, estimates and invoices. It connects to your business bank and credit card accounts to automatically download transaction data and has a proactive reconciliation process that predicts matches.

It has an iPhone app and a Chrome extension for capturing receipts. Botkeeper – Botkeeper is an accounting service that uses artificial intelligence and machine learning to automate bookkeeping, and a dedicated (human) accountant to oversee your account and handle urgent or complex issues. Businesses in any industry can use this service, and it integrates with top banks and accounting, POS, and e-commerce software. Pricing is based on the number of transactions you record each month, and there's no lengthy contract. Bottom Line Accounting – Bottom Line Accounting is desktop accounting software for PCs. The software is module-based, allowing you to customize it to suit your business's needs.

The basic kit has general ledger, bank reconciliation and financial utilities modules. You can also add modules for accounts receivable, accounts payable, inventory and point of sale, purchase order, and payroll. CenterPoint Accounting – CenterPoint Accounting from Red Wing Software has multiple editions of its accounting software for different types of organizations, including businesses, farms, nonprofits and municipal government. It supports an unlimited number of transactions, customers, suppliers and products, and there's no limit to the years of historical accounting data you can store. Payroll services are also available.

CheckMark MultiLedger – CheckMark MultiLedger is desktop accounting software for small businesses. It supports up to 10 simultaneous users, and its features include A/P, A/R, bank reconciliation, commissions, general ledger, inventory, invoicing, job tracking, purchase ordering and reporting.

The company offers a cloud backup add-on for a monthly fee. The company also offers 1099 Software, which you can use to print or e-file tax forms. ClearBooks – ClearBooks is cloud-based accounting software with a full set of A/R and A/P features. It connects to your business bank accounts, and you can use it to send quotes and invoices, manage vendors, create purchase orders, pay bills, and run reports.

It can be used by small businesses in any country. Crunched – Crunched is cloud-based accounting software designed for both new and established small businesses.

With it, you can track your finances, send quotes and invoices to customers, track bills and expenses, reconcile transactions, and generate reports. The company offers its own payment processing service, which you must use if you want to accept online invoice payments, and integrates with Gusto for payroll and HR services. Denali – This on-premises accounting system from Cougar Mountain Software can be used by businesses of all sizes, including those with multiple locations. The software is modular, allowing you to customize it with just the features you need. Modules include payroll, inventory and POS. POS hardware and e-commerce websites are also available from this company. FreeAgent – FreeAgent is cloud-based accounting software for small businesses, freelancers and consultants.

It supports unlimited users, clients and invoices for one monthly price. Features include automatic bank feeds, recurring invoices, automated payment reminders and time tracking.

It also has project management tools to help you track billable hours and expenses.FreshBooks – A favorite among small business owners, FreshBooks is one of the most user-friendly cloud-based accounting applications for non-accountants. It makes it easy to bill clients, set up recurring invoices and automatic payment reminders, and accept online payments. Its mobile app allows you to accomplish many accounting tasks on the go, such as invoicing, time tracking and managing expenses. Read our full review. GnuCash – GnuCash is free accounting software for small businesses that has a useful selection of features to help you manage your finances, such as income and expense tracking, double-entry accounting, financial reports and calculations, scheduled transactions, and statement reconciliation. It can also track bank accounts, stocks, bonds and mutual funds.

GnuCash is available for Windows, Mac, Linux and Android devices. GoDaddy Online Bookkeeping – Formerly Outright, GoDaddy Online Bookkeeping imports data from your bank, credit cards, and sales accounts such as Amazon and Etsy. It categorizes your sales and expenses, then uses this data to prepare your Schedule C taxes. You can also use this software to create, send and track invoices; accept invoice payments online; and send late-payment reminders.

Harvest – Harvest makes it easy to bill clients and get paid. It offers a simple platform that lets you easily track time and turn billable hours into professional invoices. You can also log expenses, take snapshots of receipts, generate reports, and connect the accounting program to Google Apps, Salesforce, Basecamp and more than 50 other business programs.

Hiveage – Hiveage is online invoicing software for freelancers and small businesses. It allows you to create estimates and quotes, then convert them to invoices after client acceptance.

The software tracks time, expenses and mileage. It also lets you accept online payments, including recurring payments such as subscriptions.

All plans support unlimited clients and invoices. KashFlow – With KashFlow accounting software for small businesses, you can invoice your customers, reconcile bank transactions, accept invoice payments online and generate more than 50 reports. The software includes a mobile app for Android and iOS, and integrations are available. It can be used in many countries, including the U.S., but its payroll features are exclusive to U.K.-based businesses. Kashoo – Kashoo's online accounting software can handle your invoicing, expense tracking, and double-entry bookkeeping on your computer, iPhone and iPad. It connects to your bank accounts, accepts online invoice payments, generates reports, and offers collaboration features that let you share your books with your bookkeeper, accountant and business partners at no extra cost. Less Accounting – Less Accounting is accounting software for small business owners who want to spend less time managing their finances and more time running their businesses.

It automates tasks such as data entry and billing, and it has features for invoicing, tracking expenses and mileage, managing contacts, and generating reports. The company also offers bookkeeping services. MyBooks – myBooks by Zetran is affordable cloud-based accounting software for entrepreneurs and small business owners. It has enterprise-grade security and connects to your bank feeds to automatically import your transactions.

Your key accounting metrics are displayed as charts and graphs on the dashboard, and you can easily create attractive invoices using its built-in templates. NolaPro – NolaPro by Noguska is accounting software for Windows and Linux that you can customize with modules and enhance with more than 100 addons. Features include billing, inventory, order management, payables and payroll. The company offers three plans, with a free starter plan for home-based businesses. Officewise – Formerly known as Alatus, Officewise is web-based accounting software for small businesses. It has month-to-month subscriptions and offers a free plan for very small businesses. You can use it to send quotes and invoices, manage bills and expenses, create purchase orders, track inventory, create budgets, and generate more than 50 reports.

OneUp – OneUp is online accounting software for small businesses that's especially well suited for businesses with sales teams and inventory. With it, you can create and send quotes or sales orders, convert them to invoices, track bills, and manage inventory in real time. It uses AI technology to speed up bank reconciliation and includes CRM tools so your sales team can use the software to follow up on leads. Patriot Software – Patriot Software's online accounting system for small business owners allows you to choose between cash, modified cash or accrual accounting methods. You can invoice your customers, track payments and expenses, and generate reports such as a profit and loss statement, balance sheet, and paid and unpaid customer invoices.

The company also offers payroll software.QuickBooks Online – QuickBooks Online from Intuit has both accounts receivable and payable features, and it can track projects and inventory, making it a great choice for nearly every business type. If you want to customize the software with additional features, you can choose from hundreds of apps that integrate with this system. For those who prefer to install software rather than use an online app, the company offers QuickBooks Desktop, QuickBooks Desktop for Mac, QuickBooks Premier and QuickBooks Enterprise. Read our full review. Quicken Home & Business – Quicken lets you manage both your personal and business finances in one place, making it a convenient solution for very small businesses and home-based entrepreneurs who don't need accounting software designed for larger or more established businesses. Although it's only available for Windows, it has iOS and Android apps, and the Quicken on the Web feature allows you to access key features from any browser.

Sage 50cloud Accounting – Sage 50cloud Accounting is a desktop accounting solution that automatically backs up your data to the cloud and has remote access capabilities. It integrates with Microsoft Office 365 and connects to your bank accounts to help you manage your cash flow.

Features include invoicing, inventory management, expense tracking and reporting. Sage Business Cloud Accounting – Sage Business Cloud Accounting (formerly Sage One) is affordable accounting software for small business owners. With it, you can create quotes, send invoices, accept payments, record expenses, manage contacts and generate reports. Integrations that link the software to more than 100 business applications like POS systems and payroll are available.

Sage Intacct – Sage Intacct is advanced, cloud-based financial management software for midsize businesses. It automates processes and generates a wide range of reports, giving you the ability to evaluate your business's performance from any financial angle. It integrates with Salesforce CRM and other popular business systems. Other Sage accounting products for midsize and large businesses include Sage 100cloud, Sage 300cloud, Sage Business Cloud Financials, Sage Business Cloud Enterprise Management and Sage Fixed Assets.

ScaleFactor – ScaleFactor is an automated bookkeeping solution for small and growing businesses. It processes, categorizes and uploads your transactions to your QuickBooks or Xero accounting software and then analyzes your data to give you insights that help you manage your business.

Home Accounting Software For Mac

It has a customizable dashboard, a chatbot that can answer your questions or forward them to dedicated experts, integrations, and a mobile app. SlickPie – SlickPie is online accounting software for freelancers and very small businesses. Two plans are available: The Starter plan is free, and the Pro plan carries a monthly subscription fee. Features include bank feeds, online and recurring invoicing, automatic past-due reminders, bill and expense tracking, sales tax tracking, and reporting. Tipalti – Tipalti's online accounts payable platform is designed for small and midsize businesses with 100 or more suppliers or 1099 contractors, including international ones. It estimates that it can eliminate 80 percent of your accounts payable workload by automating multiple processes, including supplier onboarding, invoice processing, tax and regulatory compliance, and account reconciliation.Wave Financial – Wave's cloud-based accounting platform is free to use and offers many of the same features as paid accounting software.

It connects to your bank and credit card accounts, tracks your income and expenses, and allows you to create and send invoices, including recurring billing. Online payment and payroll services are also available from this company. Read our full review. WorkingPoint – WorkingPoint is all-inclusive, cloud-based accounting software. It connects to your bank and credit card accounts and includes tools for invoicing, bill and expense tracking, inventory management, contact management, and financial and tax reporting.

The company also offers payroll and email marketing services.Xero – Xero online accounting software for small businesses is affordable and easy to use, and it integrates with more than 700 third-party business solutions. Features include invoicing, inventory, bank reconciliation, bill tracking, reporting, and project time and cost tracking. Xero has mobile apps for Apple and Android devices, allowing you to accomplish accounting tasks on the go. Read our full review. Yendo – Yendo small business enterprise resource planning (ERP) software comes with accounting, CRM and project management modules, as well as a dashboard that gives you a holistic look at your business. The financial module has tools to help you create invoices, send reminders, record payments and expenses, generate reports, and reconcile accounts. ZipBooks – This online accounting software offers several plans, including one that's free and one that includes bookkeeping services.

ZipBooks uses double-entry accounting, connects to your business bank accounts and generates a variety of reports to help you manage your business. It also includes invoicing, recurring invoicing, online payment acceptance, and billable time and expense tracking tools.Zoho Books – Zoho Books is full-featured accounting software with a small business price tag. Features include invoicing, automatic payment reminders, time and expense tracking, reporting, and reconciliation.

It has client portals that your customers can use to approve estimates, pay invoices and view statements. This software integrates with other Zoho applications, payment gateways like PayPal and Square, and popular business solutions like Office 365 and Slack. Read our full review. Ready to choose an accounting software solution? Here's a breakdown of our complete coverage:. If you'd like your company to be added to this list and possibly considered as a best pick for our next round of reviews, please email your request to.

Editor's note: Looking for information on accounting software for your business? Use the questionnaire below, and our vendor partners will contact you to provide you with the information and quotes you need.