Turtle Trading System Mt4 For Mac

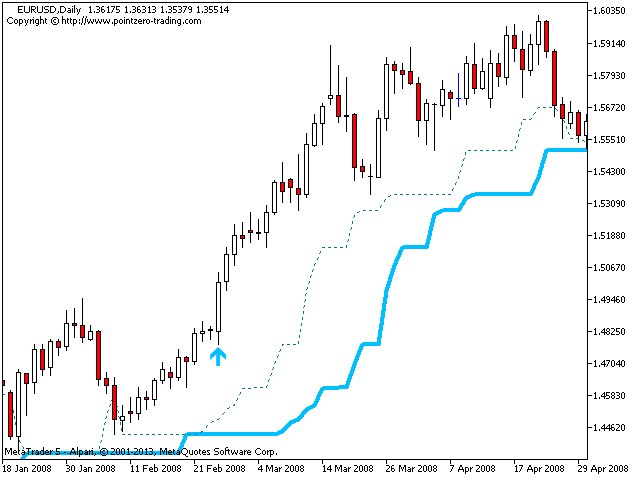

The Turtle Trading Indicator for Metatrader implements the original Richard Dennis and Bill Eckhart trading system, commonly known as The Turtle Trader. It implements the two breakout systems in a single indicator. Trade exactly like the original Turtles did.

Renko Trading System Mt4

Make sure to capture all big market movements. Follow trends to the end and profit in up or down markets. Get home run returns applying a proven trend following system This trend following system relies on breakouts of historical highs and lows to take and close trades: it is the complete opposite to the buy low and sell high approach. It is the perfect system for novice traders with low capital. The indicator implements visual/mail/sound/push alerts.

The indicator is non-repainting. Who were the Turtle Traders? The Turtle Trader legend began with a bet between American multi-millionaire commodities trader, Richard Dennis and his business partner, William Eckhardt. Dennis believed that traders could be taught to be great; Eckhardt disagreed asserting that genetics were the determining factor and that skilled traders were born with an innate sense of timing and a gift for reading market trends. What transpired in 1983-1984 became one of the most famous experiments in trading history. Averaging 80% per year, the program was a success, showing that anyone with a good set of rules and sufficient funds could be a successful trader.

In mid-1983, Richard Dennis put an advertisement in the Wall Street Journal stating that he was seeking applicants to train in his proprietary trading concepts and that experience was unnecessary. In all he took on around 21 men and two women from diverse backgrounds. The group of traders were shoved into a large sparsely furnished room in downtown Chicago and for two weeks Dennis taught them the rudiments of futures trading. Almost every single one of them became a profitable trader, and made a little fortune in the years to come.

The entry strategy The Turtles learned two breakout variants or 'systems'. System One (S1) used a 20-day price breakout for entry. However, the entry was filtered by a rule that was designed to increase the odds of catching a big trend, which states that a trading signal should be ignored if the last signal was profitable. But this filter rule had a built-in problem. What if the Turtles skipped the entry breakout and that skipped breakout was the beginning of a huge and profitable trend that roared up or down? Not good to be on the sidelines with a market taking off! If the Turtles skipped a System One 20-day breakout and the market kept trending, they could and would get back in at the System Two (S2) 55-day breakout.

This fail-safe System Two breakout was how the Turtles kept from missing big trends that were filtered out. The entry strategy using System Two is as follows:. Buy a 55-day breakout if we are not in the market.

Short a 55-day breakout if we are not in the market The entry strategy using System One is as follows:. Buy a 20-day breakouts if last S1 signal was a loss. Short a 20-day breakouts if last S1 signal was a loss The Turtles calculated the stop-loss for all trades using the Average True Range of the last 30 days, a value which they called N. Initial stop-loss was always ATR(30).

2, or in their words, two volatility units. Additionally, the Turtles would pile profits back into winning trades to maximize their winnings, commonly known as pyramiding. They could pyramid a maximum of 4 trades separated from each other by 1/2 volatility unit. The exit strategy The Turtles learned to exit their trades using breakouts in the opposite direction, which allowed them to ride very long trends. The exit strategy using System Two is as follows:. Exit long positions when the price touches a 20-day low. Close shorts positions when the price touches a 20-day high The exit strategy using System One is as follows:.

Close long positions if/when the price touches 10-day low. Close short positions if/when the price touches a 10-day high Money Management The initial risk allocation for all trades was 2%. However, aggressive pyramiding of more and more units had a downside: if no big trend materialized, then those little losses from false break-outs would eat away even faster at the Turtles' limited capital.

Mac Word Counter app tracks how many words you write to increase your productivity. Word Counter 2.10.1 - Counts words entered into a text field. Download the latest versions of the best Mac apps at safe and trusted MacUpdate. Microsoft word for mac. About Word Counter Widget A Dashboard widget for Macintosh OS X. It provides word counts and character counts and can also count the number of instances. Word Counter is a Macintosh OS X application that performs a word count. Word Counter will provide the word and character count for the text, and it will. Word Counter is now a Universal Binary (will work on PowerPC and Intel Macs).

How did Eckhardt teach the Turtles to handle losing streaks and protect capital? They cut back their unit sizes dramatically.

When markets turned around, this preventive behavior of reducing units increased the likelihood of a quick recovery, getting back to making big money again. The rules were simple. For every 10 percent in drawdown in their account, Turtles cut their trading unit risk by 20 percent. This of course applies for bigger numbers: the unit risk would be decreased by 80% with a 40% drawdown! What to trade What you trade is critical.

It may just be the most important issue and it is the only discretionary decision you'll have to make. Here is the catch: you cannot trade everything, but you cannot trade only one market either. You need to be in position to be following enough markets that when a market moves you can ride it, as diversification is the only free lunch you get. It allows you to spread your potential targets of opportunity broadly across currencies, interest rates, global stock indices, grains, meats, metals and energies.

The Turtle trading system (rules and explanations further below) is a classic trend following system. Using several classic trend following systems, we publish the Wisdom State of Trend Following report on a monthly basis. The report was built to reflect and track the generic performance of trend following as a trading strategy. The composite index is made up of a mix of systems (similar to the Turtle system) simulated over multiple timeframes and a portfolio of futures, selected from the range of that Wisdom Trading can provide clients access to. The portfolio is global, diversified and balanced over the main sectors. We publish updates to the report every month. The Turtle Trading System Explained The Turtle Trading System trades on breakouts similar to a Donchian Dual Channel system.

There are two breakout figures, a longer breakout for entry, and a shorter breakout for exit. The system also optionally uses a dual-length entry where the shorter entry is used if the last trade was a losing trade. The Turtle system uses a stop based on the Average True Range (ATR). Note that the Turtle concept of N has been replaced by the more common and equivalent term Average True Range (ATR). Trade Long/Short This parameter tells Trading Blox whether or not trades in the short direction are to be taken. Trade if Last is Winner When this parameter is set to False (unchecked and disabled), Trading Blox looks back at the last entry breakout for that instrument and determines if it would have been a winner, either actually, or theoretically.

If the last trade was, or would have been a winner, then the next trade is skipped, regardless of direction (long or short). The last breakout is considered to be the last breakout in that market regardless of whether or not that particular breakout was actually taken, or was skipped because of this rule. (Trading Blox looks back only at “regular” breakouts, and not Entry Failsafe Breakouts.) The direction of the last breakout-long or short-is irrelevant to the operation of this rule, as is the direction of the trade currently being considered. Thus, a losing long breakout or a losing short breakout, whether hypothetical or actual, would enable the subsequent new breakout to be taken as a valid entry, regardless of its direction (long or short): Some traders believe that two large, consecutive wins are unlikely, or that a profitable trade is more likely to follow a losing trade. Trading Blox allows you to test this idea by setting this parameter to False. Entry Breakout (days) A trade is entered when the price hits the high or the low of the preceding X-days, as adjusted by the Entry Offset.

For example, Entry Breakout = 20 means that a long position is taken if price hits the 20-day high; A short position is taken if price hits the 20-day low. Entry Failsafe Breakout (days) This parameter works in concert with Trade if Last is Winner, and is used only if Trade if Last is Winner = False (as is shown in the partial screen shot above). For example, consider the following set of parameters and values: With these settings, if a 20-day breakout entry was recently signaled, but was skipped because the prior trade was a winner (either actually, or theoretically), then if the price breaks out above or below the 55-day extreme high or low, an entry is initiated for that position regardless of the outcome of the prior trade. Entry Failsafe Breakout keeps you from missing very strong trends due to the action of the Trade if Last is Winner rule. Entry Offset (ATR) If set to zero, this parameter has no effect. If Entry Offset in ATR is set to 1.0, a long position isn’t entered until price hits the normal breakout price, plus 1.0 ATR. Likewise, a short position won’t be entered until the price hits the normal breakout price, minus 1.0 ATR.

Either a positive or negative value can be specified for this parameter. A positive value effectively delays entry until the specified point after the breakout threshold chosen; a negative value would enter before the breakout threshold chosen. Unit Add (ATR) This parameter defines the price at which additions to an existing position are made.

The Turtles entered single Unit positions at the breakouts, and added to those positions at 1/2 ATR intervals following trade initiation. (Adding to existing positions is often referred to as “pyramiding.”) Following the initial breakout entry, Trading Blox will continue to add a Unit (or Units, in the case of a large price move in a single day), at each interval defined by Unit Add in ATR, as price progresses favorably, right up to the maximum permitted number of Units, as specified by the various Max Units rules (explained below). During historical simulation tests, the theoretical entry price is adjusted up or down by Slippage Percent and/or Minimum Slippage, to obtain the simulated fill price. So each interval is based on the simulated fill price of the previous order. So if an initial breakout order slipped by 1/2 ATR, the new order would be moved to account for the 1/2 ATR slippage, plus the normal unit add interval specified by Unit Add in ATR. The exception to this rule is when multiple Units are added in a single day during a trade in progress.

Range Bar Trading System Mt4

For example, with Unit Add in ATR = 0.5, the initial breakout order is placed and incurs slippage of 1/2 ATR. Several days later, two more units are added on the same day. In this case, the order price of both the 2nd and 3rd Units is adjusted up by 1/2 ATR (to 1 full ATR past the breakout), based on the slippage incurred by the 1st Unit. Ordinarily, in the case where several Units have been added (each on a separate day), the order price of each Unit is adjusted by the cumulative slippage (in N) of all the Units that preceded it on the trade in progress. Stop (ATR) This parameter defines the distance from the entry price to the initial stop, in terms of ATR. Since ATR is a measure of daily volatility and the Turtle Trading System stops are based on ATR, this means that the Turtle System equalizes the position size across the various markets based on volatility. According to the original Turtle Rules, long positions were stopped out if price fell 2 ATR from the entry price.

Conversely, short positions were stopped out if the price rose 2 ATR from the entry price. Unlike the Exit Breakout based stop, which moves up or down with the X-day high or low, the stop defined by Stop in ATR is a “hard” stop that is fixed above or below the entry price upon entry. Once set, it does not vary throughout the course of the trade, unless Units are added, in which case the for earlier units are raised by the amount specified by Unit Add (ATR).

Trades are liquidated when price hits the stop defined by either the Stop in ATR, the Entry Breakout for the opposite direction, or the Exit Breakout (see above), whichever is closest to the price at the time. In this system the initial entry stop for the trade entry day is based on the order price.

This is for ease of placing the stop once the order is filled. Note that the stop is adjusted based on the actual fill price for the following day. Exit Breakout (days) Trades in progress are exited when the price hits the high or the low of the preceding X-days as adjusted by the Exit Offset. This concept is the identical to Entry Breakout, but the logic is reversed: Long trades are exited when price breaks out below the X-day low, and short trades are exited when price breaks out above the X-day low. The Exit Breakout moves up (or down) with price. It protects against adverse price excursions, and also serves as a trailing stop that acts to lock in a profit when the trend reverses.

Trades are liquidated when price hits the stop defined by either the Stop in ATR, the Entry Breakout for the opposite direction, or the Exit Breakout (see above), whichever is closest to the price at the time. Exit Offset (ATR) If set to zero, this parameter has no effect. If Exit Offset in ATR is set to 1.0, a long position isn’t exited until price hits the normal breakout price, minus 1.0 ATR. Likewise, a short position won’t be exited until the price hits the normal breakout price, plus 1.0 ATR. Either a positive or negative value can be specified for this parameter. A positive value effectively delays exit until the specified point after the breakout threshold chosen; a negative value would exit before the breakout threshold chosen.

Max Instrument Units This parameter defines the maximum number of Units that can be held at one time, in any single futures market, or any single stock. For instance, Max Instrument Units = 4 means that no more than 4 Units of Coffee may be held at one time; this includes the initial Unit, plus 3 Units added. Your Custom Version of this System We can provide you with a customized version of this system to suit your trading objectives. Portfolio selection/ diversification, timeframe, starting capital We can adjust and test any parameter to your requirements. To discuss and/or request a full custom simulation report. Alternative Systems In addition to the public trading systems, we offer to our clients several, with strategies ranging from long-term trend following to short-term mean-reversion.

We also provide full execution services for a fully automated strategy trading solution. Please click on the picture below to see our CFTC-required risk disclosure for hypothetical results Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading.

For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Wisdom Trading Wisdom Trading is an NFA-registered Introducing Broker. We offer Global commodity brokerage services, managed futures consultation, direct access trading, and trading system execution services to individuals, corporations and industry professionals. As an Independent introducing broker we maintain clearing relationships with several major Futures Commission Merchants around the globe. Multiple clearing relationships allow us to offer our clients a wide range of services and exceptionally wide range of markets. Our clearing relationships provide clients with 24hr access to futures, commodities, and foreign exchange markets around the globe.

Turtle Trading System Mt4 For Mac Mac

Futures trading involves a substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results.